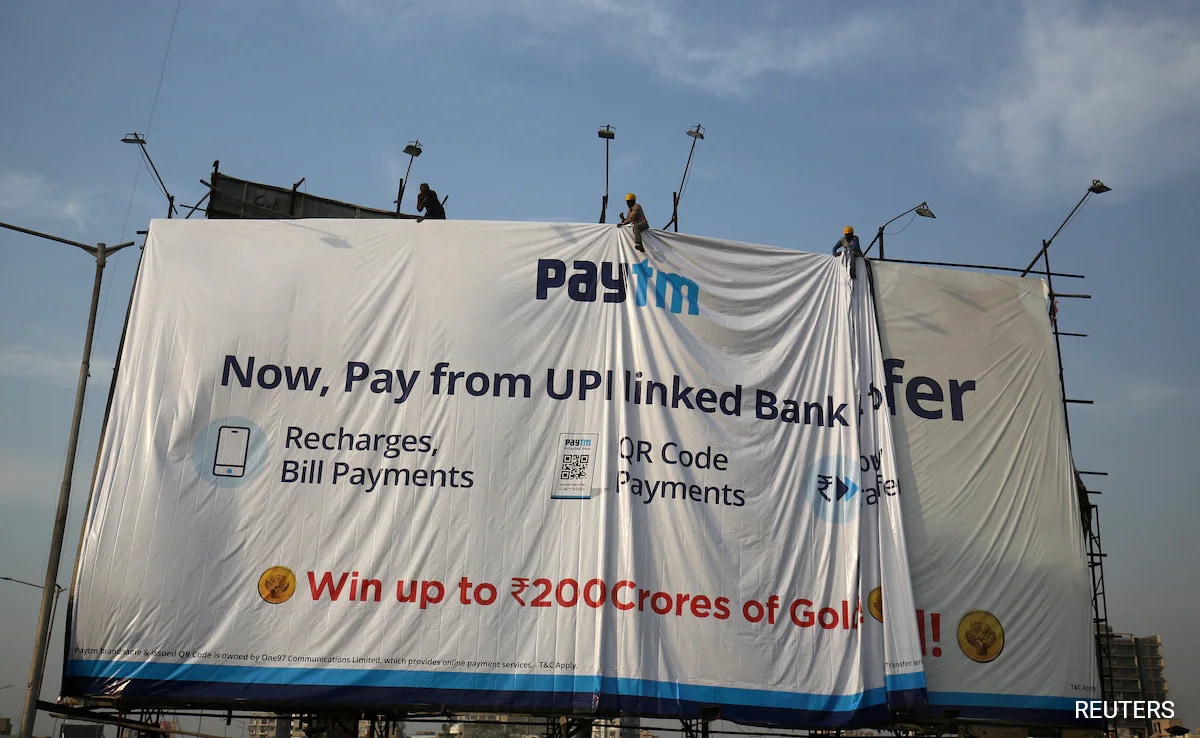

Digital payments firm Paytm lost a fifth of its market value on Thursday after the Reserve Bank of India (RBI) directed its associate Paytm Payments Bank to halt its business, sparking a meme fest on the internet.

Most of the memes on social media platforms were aimed at Paytm stockholders.

Here are some of the hilarious memes that were shared on X, formerly Twitter.

The song dedicated to PAYTM investors by Paytm promoter #Paytm pic.twitter.com/HU2ARRNbDa

— ASAN (@Atulsingh_asan) February 1, 2024

#Paytm share holders today. pic.twitter.com/P9G7ScbNDj

— Pritesh Shah (@priteshshah_) February 1, 2024

#Paytm share holders after crash in prices pic.twitter.com/dWASxNnEly

— Nocturnal Soul (@Mirage_gurrl) February 1, 2024

#Paytm investors be like .. pic.twitter.com/FpzVmdbPa5

— Mukesh (@mikejava85) February 1, 2024

RBI restricts multiple services of Paytm Payments Bank ?

Meanwhile paytm#Paytm #PaytmBank #BudgetSession2024 pic.twitter.com/3i7QPsdmm9

— Rahul Chauhan (@RahulCh9290) February 1, 2024

Me watching #Paytm shares in my portfolio today pic.twitter.com/9YKbgOk121

— Vivek Gautam (@Imvivek04) February 1, 2024

#Paytm stock holders right now ?pic.twitter.com/7Bm4BIT1AY

— Tweeting Quarantino (@rohitadhikari92) February 1, 2024

Paytm’s stock reportedly fell to a six-week low of Rs 609, erasing around $1.2 billion in value from the company, a day after the RBI put restrictions on Paytm Payments Bank.

The stock was down 20%, at the bottom of its exchange-imposed daily trading band.

Paytm on Thursday said it expects a “worst case impact” of ₹ 300 crore to ₹ 500 crore to its annual earnings from RBI’s order. The company also said it is taking “immediate steps” to comply with the RBI’s directions and that it expects to “continue on its trajectory” to improve its profitability.

Earlier on Wednesday, the central bank told Paytm Payments Bank that it will not be able to take fresh deposits, facilitate credit transactions, or offer fund transfers, including the Unified Payments Interface (UPI) facility after February 29, 2024.

“No further deposits or credit transactions or top ups shall be allowed in any customer accounts, prepaid instruments, wallets, FASTags, NCMC cards, etc. after February 29, 2024, other than any interest, cashbacks, or refunds which may be credited anytime,” the RBI said.

The RBI said it had in March 2022 asked the Paytm Payments Bank to stop onboarding new customers.

However, a Comprehensive System Audit report and subsequent compliance validation report of the external auditors revealed persistent non-compliances and continued material supervisory concerns in the bank, warranting further supervisory action, the RBI said, without disclosing details.